Understanding Employment Gratuity Under UAE Labour Law

In a global employment hotspot like the UAE, understanding employee rights and benefits is important for both employers and employees. Gratuity, or the end-of-service benefit, is a vital financial reward paid by an employer to an employee as a mark of gratitude for their service and contributions. It provides a financial safety net when an employee leaves an organization.

The end-of-service gratuity for expatriate employees in the UAE is governed by Federal Decree-Law No. 33 of 2021 on the Regulation of Labour Relations and its Executive Regulation, Cabinet Resolution No. 1 of 2022.

Who is an employer and employee under the UAE Labour Law?

Every natural or legal person employing one or more workers in return for a wage can be called an employer, and every natural person authorised by the Ministry to work for one of the licensed establishments in the state, under the supervision and direction of an employer, can be called a worker. The term ‘establishment’ can include every economic, technical, industrial or commercial unit licensed by the competent authorities, whose objective is to produce or market commodities or to provide services.

Scope of application of the Gratuity Provisions under the Decree Law

The Decree-Law, including its gratuity provisions, applies to all establishments, employers, and workers in the UAE’s private sector.

Exclusions: The following are excluded from the Decree-Law and are governed by separate regulations:

- Employees of federal and local government agencies.

- Members of the armed forces, police, and security forces.

- Domestic workers.

Gratuity for Different Types of Employment Contracts and its Calculation under the UAE Law

The Decree Law envisages provisions on gratuity benefits for workers under full-time contracts and for workers of other types of work.

End of service benefits for workers under full-time contracts.

Under full-time contracts, an employee under his/her employment agreement undertakes to work the full standard hours regularly and continuously for the employer, unlike part-time, temporary, or casual workers. End-of-service benefits for workers under full-time contracts are discussed by the Decree Law under its Article 51.

- UAE Nationals: The UAE nationals or Emiratis who work as full-time workers in a private sector establishment shall be entitled to gratuity upon the end of his/her service, in accordance with the UAE’s legislation regulating pensions and social security, which is Federal Law by Decree No. (57) of 2023 Concerning Pension and Social Security.

- Foreign Workers: The foreign workers working in the private sector as full-time workers shall be entitled to an end-of-service gratuity upon the end of their service, provided he/she has completed one or more years of continuous service.

Calculating Gratuity for Full-Time Foreign Workers

The gratuity benefits for foreigners who are full-time workers will be calculated according to their last basic wage received (for those receiving monthly, weekly, or daily wages). For the workers who are paid on a piecework basis, it shall be calculated according to their average daily wage.

- For the first five years of service, i.e., if a worker has served for more than 1 year but less than or equal to 5 years, the worker will be entitled to a basic wage of 21 days for each year.

- For each year after the first five years, the worker shall be entitled to a wage of 30 days for each year.

However, in all the above cases, the total end of service benefits for a foreign worker shall not exceed their two years’ wages. Moreover, the employer may deduct from the end of service benefits any amounts payable or due by the worker under the law or a judgment.

A foreign worker shall also be entitled to a bonus in proportion to the time he has worked in that year.

However, it is to be noted that, while calculating the gratuity benefits, the period of service shall not include days wherein the worker has taken unpaid leave (unpaid days of absence from work), i.e., only the days actually worked by the worker are counted towards service length.

End of service benefits for workers under other types of employment

Temporary work contracts may be for a duration less than the employee’s ability or qualifications, and with specific conditions for termination and end-of-service gratuity. Organisations may have employees operating under a part-time or job-sharing model, and not under a full-time model. Article 30 of Cabinet Resolution No. 1 of 2022 provides for its calculation as follows:

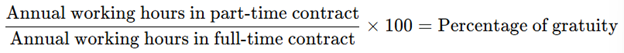

The number of hours such employees work per year shall be compared with the number of hours a full-time worker would work. Hence, the calculation formula shall be:

Then this percentage should be multiplied by the value of the end of service benefit due for the full-time contract.

However, for workers operating under a temporary employment model or for a duration less than a year, these gratuity benefits shall not apply.

Gratuity Payment Timeline:

The Article 53 mandates that an employer shall pay the worker’s wages and all other entitlements, including end-of-service benefits of gratuity, within a period of 14 days from the end date of the employment contract or the date on which the worker leaves.

Impact of Employee Termination on his Gratuity:

The Gratuity in cases where the employment contract was terminated due to the event of the worker’s death, the employer may hand over such benefits to the worker’s family within 10 days from the date of death or the date the employer became aware of it.

If a worker’s service is unlawfully terminated, the compensation awarded to the worker by the court for such unlawful termination does not prejudice the worker’s right to obtain end of service benefits of gratuity, as outlined under Article 47.

Gratuity, for the UAE employees, is a financial safety net statutorily entitled to them by the 2021 Federal Decree Law. It provides them with financial security and recognition for years of service. Lack of compliance with the UAE’s employment or labour law framework can entail the employers’ legal disputes and challenges. Hence, understanding employment law is crucial for both the employees and the employers to maintain fair workplace practices. In cases of uncertainty or conflict, seeking professional legal advice ensures proper interpretation of the law and effective resolution.

By entering the email address you agree to our Privacy Policy.